1

1

www.angelbroking.com

Market Outlook

December 06, 2019

www.angelbroking.com

Market Cues

Indian markets are likely to open positive tracking global indices and SGX Nifty.

The US markets showed a lack of direction over the course of the trading day on

Thursday. The major averages spent the day bouncing back and forth across the

unchanged line. Dow inched up 0.1 percent to 27,677 and Nasdaq crept up 0.1

percent to 8,570.

The UK stocks edged lower on Thursday, with exporters suffering losses as the

pound continued to rise on expectations that next week's general election will not

result in a hung parliament. The FTSE 100 was down by 0.2 per cent to 7,175.

On domestic front, Indian shares fell on Thursday, with rate-sensitive banking and

auto stocks pacing the decliners, after the Reserve Bank of India (RBI) kept its policy

rate unchanged, surprising market participants who were expecting at least a 25-

basis points rate cut. The benchmark BSE Sensex was down by 0.2 per cent to

40,779.

News Analysis

Mankind Pharma eyes acquisition of biotech firms, plans new launches

Detailed analysis on Pg2

Investor’s Ready Reckoner

Key Domestic & Global Indicators

Stock Watch: Latest investment recommendations on 150+ stocks

Refer Pg5 onwards

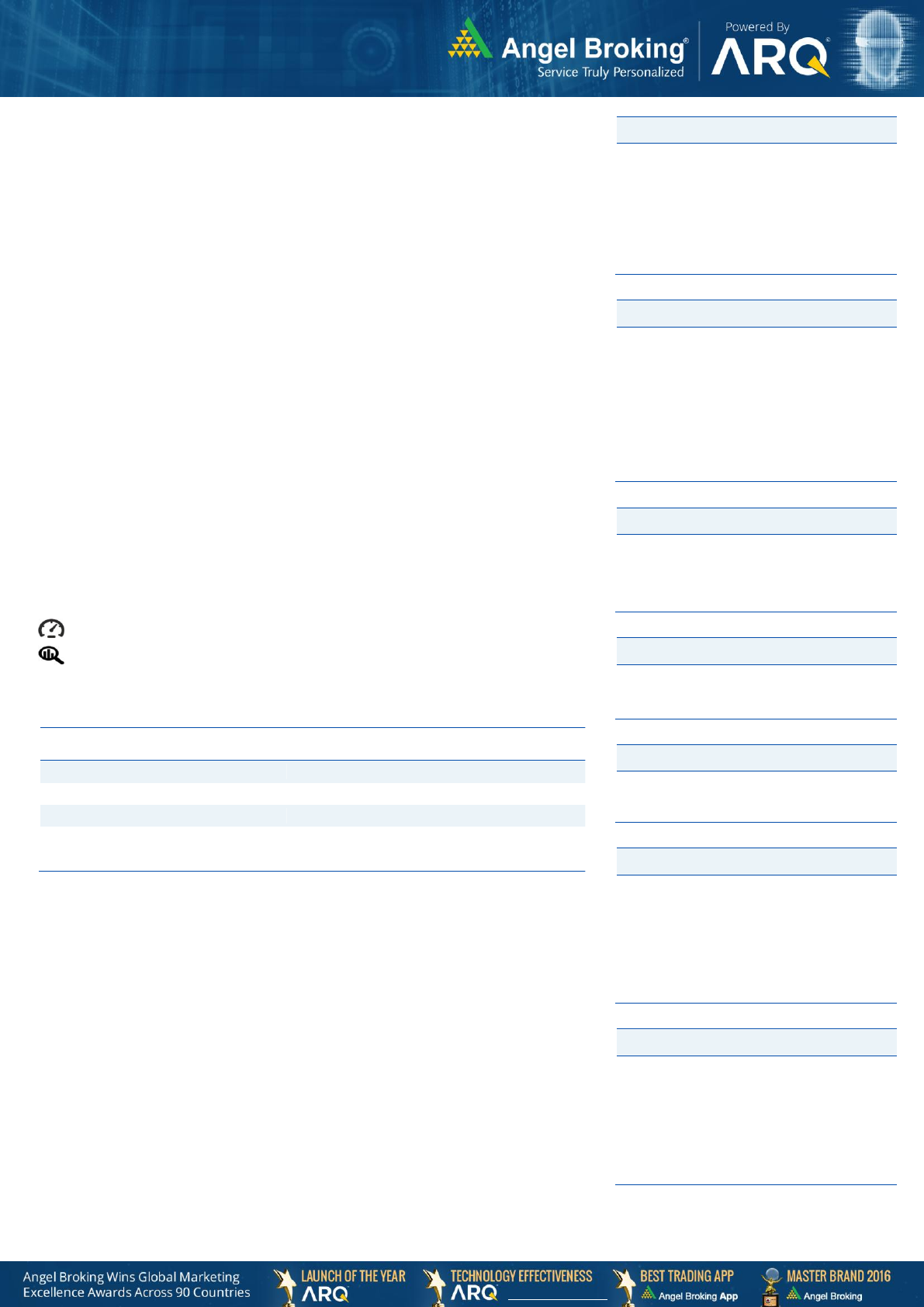

Top Picks

Company

Sector

Rating

CMP

(`)

Target

(`)

Upside

(%)

Blue Star

Capital Goods

Buy

814

990

21.6

ICICI Bank

Financials

Accumulate

528

532

0.8

GMM Pfaudlers

Others

Accumulate

1,646

2,059

25.1

Bata India

Others

Accumulate

1,707

1,865

9.3

HDFC Bank

Financials

Accumulate

1,245

1,390

11.6

More Top Picks on Pg4

Domestic Indices

Chg (%)

(Pts)

(Close)

BSE Sensex

(0.2)

(71)

40,779

Nifty

(0.2)

(25)

12,018

Mid Cap

(0.3)

(49)

14,855

Small Cap

0.01

2

13,455

Bankex

(0.8)

(276)

36,147

Global Indices

Chg (%)

(Pts)

(Close)

Dow Jones

0.1

28

27,677

Nasdaq

0.1

5

8,570

FTSE

(0.2)

(13)

7,175

Nikkei

0.7

167

23,300

Hang Seng

0.6

155

26,217

Shanghai Com

0.7

21

2,899

Advances / Declines

BSE

NSE

Advances

1,129

778

Declines

1,351

992

Unchanged

193

370

Volumes (` Cr)

BSE

2,073

NSE

34,088

Net Inflows (` Cr)

Net

Mtd

Ytd

FII

(1,448)

(1,448)

(2,16,790)

*MFs

(123)

(6,582)

43,127

Top Gainers

Price (

`

)

Chg (%)

TATAELXSI

862

6.8

EQUITAS

112

6.8

ZEEL

300

6.7

JKTYRE

77

6.1

JUBILANT

533

5.9

Top Losers

Price (

`

)

Chg (%)

JINDALSTEL

141

-8.4

INDIGO

1,320

-6.1

HUDCO

38

-5.8

IDEA

7

-5.6

JPASSOCIAT

2

-4.8

As on Dec 05, 2019

2

www.angelbroking.com

Market Outlook

December 06, 2019

www.angelbroking.com

News Analysis

Mankind Pharma eyes acquisition of biotech firms, plans new

launches

Mankind Pharma is looking for buyouts in the biotechnology space after talks with

Bharat Serums and Vaccines fell through. The firm feels a manufacturing site

would be crucial for its biotechnology business and is open to inorganic acquisition

in this space. It is also all set to launch a synthetic female hormone product — the

first Indian firm and the second globally, after Abbott. The acute therapy-focused

company has recently shifted its focus to chronic therapy areas like diabetes and

cardiac ailments. It is also driving 5 per cent of its turnover towards research and

development (R&D). The bulk of the R&D cost is towards biosimilars.

However, Mankind, a Rs 5,600-crore firm, is also keen to launch products in

the biotechnology space and is open to inorganic acquisition in the segment. “For

the biotechnology segment, we are open to inorganic growth. We are looking to

acquire a suitable target that would bring in brands, as well as manufacturing

sites. We plan to launch biotech products in the infertility segment. We were in

talks with Bharat Serums, but the talks fell through,” said R C Juneja, founder and

chairman of Mankind Pharma.

Economic and Political News

RBI's policy surprise: Pause on rate cuts may hit real estate, auto sectors

India's manufacturing capacity utilisation declines to the lowest ever

RBI keeps repo rate unchanged at 5.15%, stance stays accommodative

Corporate News

Fixed deposit holders of debt-laden DHFL asked to submit claims by Dec 17

Tata Motors to set up regional stockyards to ensure car delivery in 3 days

Mankind Pharma eyes acquisition of biotech firms, plans new launches

Govt moves NCLAT against NCLT order making MCA party in all IBC cases

3

www.angelbroking.com

Market Outlook

December 06, 2019

www.angelbroking.com

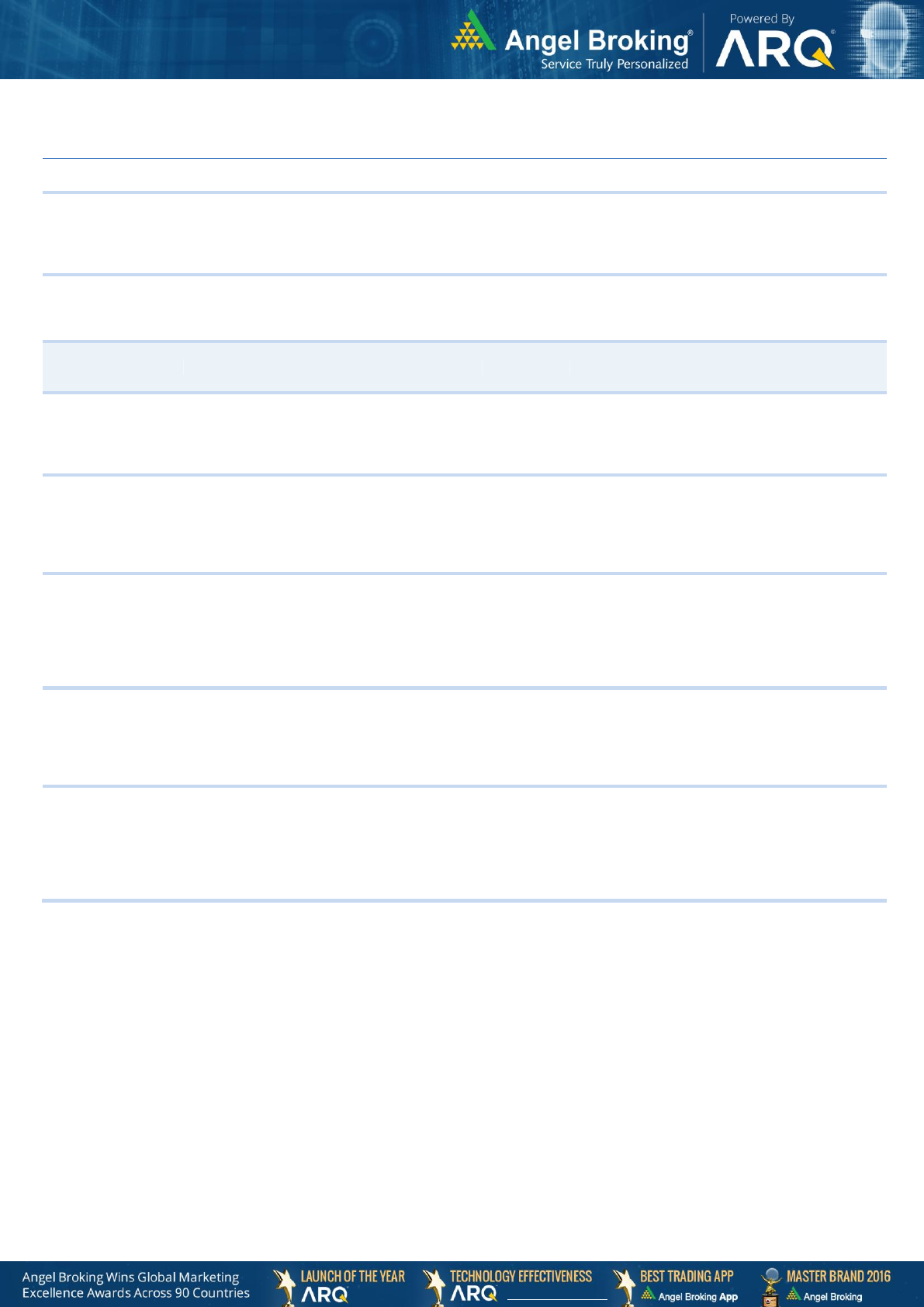

Top Picks

Company

Market Cap

(` Cr)

CMP

(`)

Target

(`)

Upside

(%)

Rationale

Blue Star

78,395

814

990

21.6

Favorable outlook for the AC industry to augur well

for Cooling products business which is out pacing

the market growth. EMPPAC division's profitability

to improve once operating environment turns

around.

ICICI Bank

34,13,497

528

532

0.8

Well capitalized with CAR of 18.1% which gives

sufficient room to grow asset base. Faster

resolution of NPA would reduce provision cost,

which would help to report better ROE.

Maruti Suzuki

21,16,252

7,006

8,552

22.1

GST regime and the Gujarat plant are expected to

improve the company’s sales volume and margins,

respectively.

Safari Industries

13,052

584

1,000

71.3

Third largest brand play in luggage segment

Increased product offerings and improving

distribution network is leading to strong growth in

business. Likely to post robust growth for next 3-4

years

Parag Milk Foods

12,100

144

200

39.0

One of the leading Indian dairy products

companies in India created strong brands in dairy

products. Rising revenue share of high-margin

Value Added Products and reduction in interest cost

is likely to boost margins and earnings in next few

years.

HDFC Bank

68,19,571

1,245

1,390

11.6

HDFC Bank maintained its steady growth in the

4QFY18. The bank’s net profit grew by 20.3%.

Steady growth in interest income and other income

aided PAT growth. The Strong liability franchise

and healthy capitalisation provides strong earning

visibility. At the current market price, the bank is

trading at 3.2x FY20E ABV.

Amber Enterprises

33,437

1,063

1,100

3.5

Market leader in the room air conditioner (RAC)

outsourced manufacturing space in India with a

market share of 55.4%. It is a one-stop solutions

provider for the major brands in the RAC industry

and currently serves eight out of the 10 top RAC

brands in India

Bata India

2,19,377

1,707

1,865

9.3

BIL is the largest footwear retailer in India, offering

footwear, accessories and bags across brands. We

expect BIL to report net PAT CAGR of ~16% to

~`3115cr over FY2018-20E mainly due to new

product launches, higher number of stores addition

and focus on women’s high growth segment and

margin improvement

4

www.angelbroking.com

Market Outlook

December 06, 2019

www.angelbroking.com

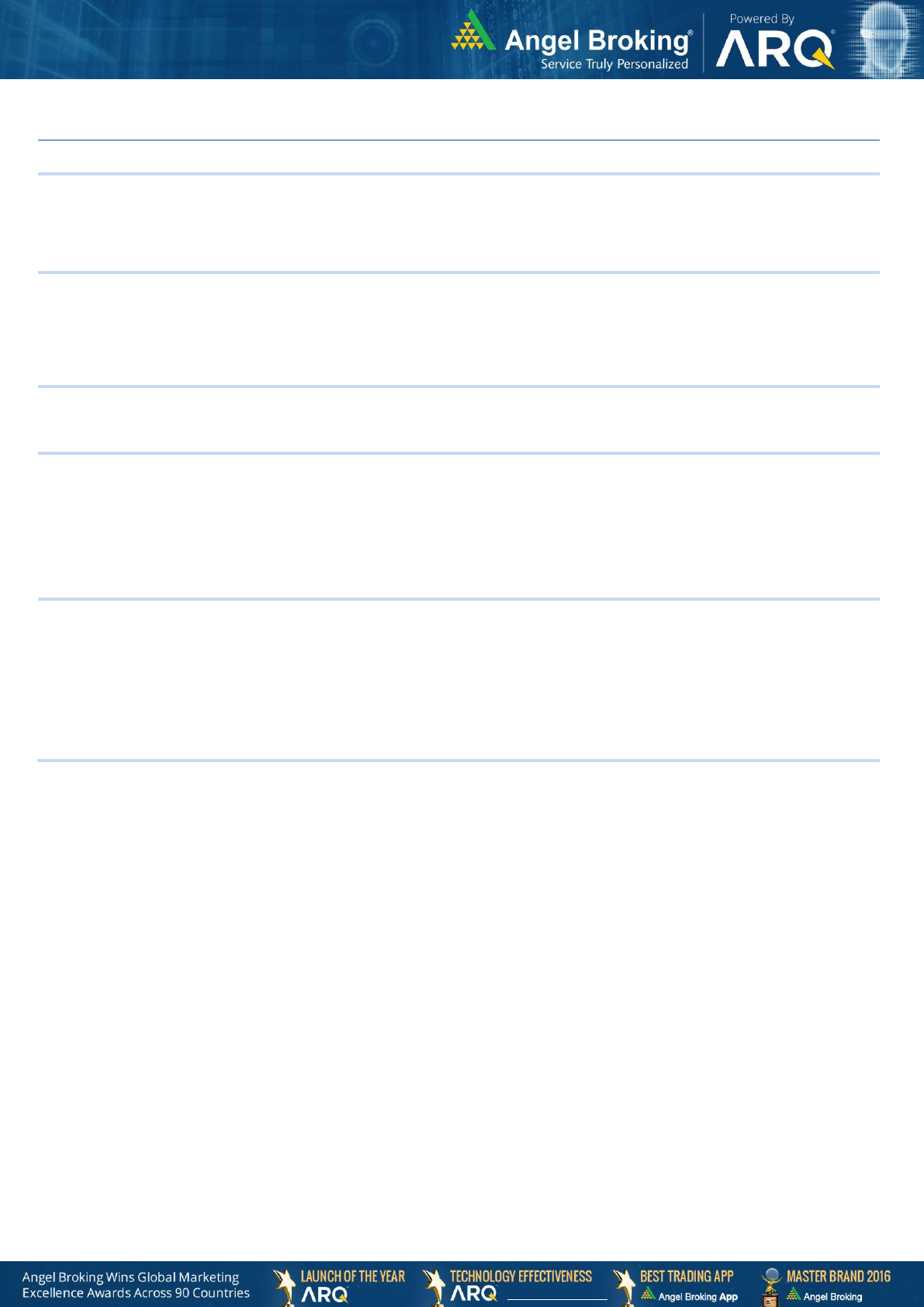

Continued...

Company

Market Cap

(` Cr)

CMP

(`)

Target

(`)

Upside

(%)

Rationale

Shriram Transport Finance

2,51,383

1,108

1,410

27.3

SHTF is in the sweet spot with benefits from

stronger CV volumes, NIMs unaffected by

rising bond yields on the back of stronger

pricing power and an enhancing ROE by

750bps over FY18-20E, supported by decline

in credit cost.

GMM Pfaudler Ltd

24,055

1,646

2,059

25.1

GMM Pfaudler Limited (GMM) is the Indian

market leader in glass-lined (GL) steel

equipment. GMM is expected to cross CAGR

15%+ in revenue over the next few years

mainly led by uptick in demand from user

industries and it is also expecting to increase

its share of non-GL business to 50% by 2020.

RBL Bank

1,57,392

365

410

12.2

We believe advance to grow at a healthy

CAGR of 35% over FY18-20E. Below peers

level ROA (1.2% FY18) to expand led by

margin expansion and lower credit cost.

Larsen & Toubro

18,26,972

1,302

1,850

42.1

The company has a strong order backlog of

~` 3lakh cr. and a very strong pipeline of `9

lakh cr. for FY2020. We are positive on

the prospects of the Company given the

Government’s thrust on Infrastructure with

over 100lakh cr. of investments lined up over

the next 5 years. Reduction in tax rate

for domestic companies to 22% from 30% will

improve profitability for the company.

Ultratech Cement

12,00,721

4,160

4,982

19.8

Post merger of Century textile’s cement

division of 13.4mn TPA from H2FY20

company will have ~110mn TPA of capacity

with a dominant position in West and central

India. We are positive on the long term

prospects of the Company given ramp up

from acquired capacities and pricing

discipline in the industry. Reduction in tax rate

for domestic companies to 22% from 30% will

improve profitability for the company.

Source: Company, Angel Research

5

www.angelbroking.com

Market Outlook

December 06, 2019

www.angelbroking.com

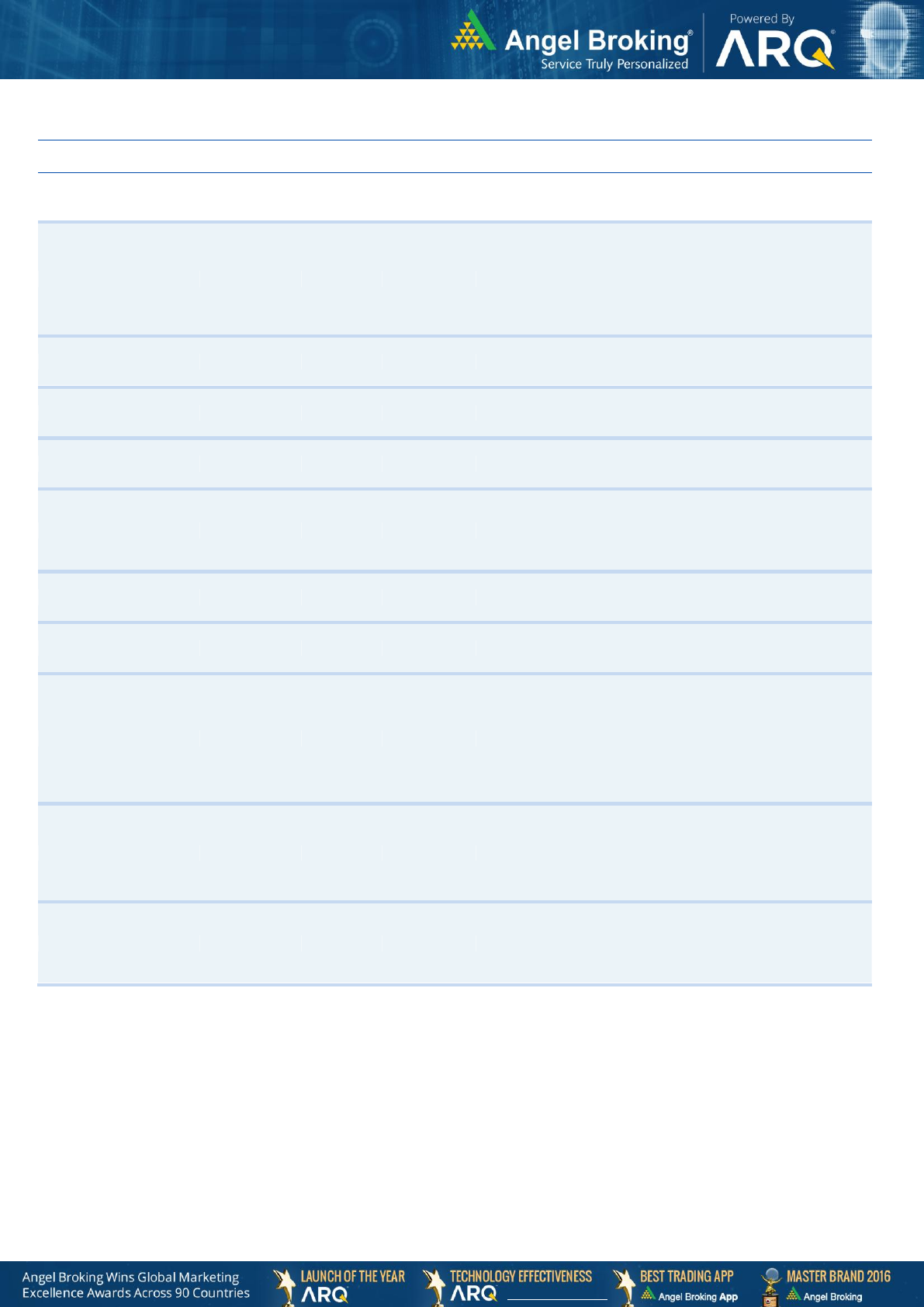

Fundamental Call

Company

Market Cap

(` Cr)

CMP

(`)

Target

(`)

Upside

(%)

Rationale

CCL Products

26,586

200

360

80.1

CCL is likely to maintain the strong growth

trajectory over FY18-20 backed by capacity

expansion and new geographical foray

Greenply Industries

19,657

160

256

59.7

Greenply Industries Ltd (GIL) manufactures

plywood & allied products and medium density

fibreboards (MDF). GIL to report net revenue CAGR

of ~14% to ~`2,478cr over FY2017-20E mainly

due to healthy growth in plywood & lamination

business on the back of strong brand and

distribution network

L&T Finance Holding

2,31,459

116

150

29.6

L&T Fin’s new management is on track to achieve

ROE of 18% by 2020 and recent capital infusion of

`3000cr would support advance growth.

Aditya Birla Capital

2,47,147

107

118

10.4

We expect financialisation of savings and

increasing penetration in Insurance & Mutual fund

would ensure steady growth.

KEI Industries

40,011

503

612

21.6

High order book execution in EPC segment, rising

B2C sales and higher exports to boost the revenues

and profitability

Nilkamal

19,204

1,287

NA

NA

We forecast Nilkamal to report top-line CAGR of

~9% to `2,635cr over FY17-20E on the back of

healthy demand growth in plastic division. On the

bottom-line front, we estimate ~10% CAGR to

`162cr owing to improvement in volumes.

Siyaram Silk Mills

10,483

224

NA

NA

Strong brands and distribution network would

boost growth going ahead. Stock currently trades

at an inexpensive valuation.

Music Broadcast Limited

7,854

28

NA

NA

Expected to benefit from the lower capex

requirement and 15 year long radio broadcast

licensing.

Inox Winds

9,576

43

NA

NA

We expect Inox Wind to report exponential growth

in top-line and bottom-line over FY19-20E. The

growth would be led by changing renewable

energy industry dynamics in favor of wind energy

segment viz. changes in auction regime from Feed-

In-Tariff (FIT) to reverse auction regime and

Government’s guidance for 10GW auction in FY19

and FY20 each.

Ashok Leyland

2,24,274

76

NA

NA

Considering the strong CV demand due to change

in BS-VI emission norms (will trigger pre-buying

activities), pick up in construction activities and no

significant impact on industry due to recent axle

load norms, we recommend BUY on Ashok Leyland

at current valuations.

Jindal Steel & Power Limited

1,43,720

141

NA

NA

We expect JSPL’s top line to grow at 27% CAGR

over FY19-FY20 on the back of strong steel

demand and capacity addition. On the bottom line

front, we expect JSPL to turn in to profit by FY19 on

back of strong operating margin improvement.

6

www.angelbroking.com

Market Outlook

December 06, 2019

www.angelbroking.com

Continued...

Company

Market Cap

(` Cr)

CMP

(`)

Target

(`)

Upside

(%)

Rationale

GIC Housing

8,331

155

NA

NA

We expect loan book to grow at 24.3% over

next two year; change in borrowing mix will

help in NIM improvement

Source: Company, Angel Research